Tezos (XTZ)

What is Tezos?

Tezos is a blockchain platform designed for smart contracts and decentralized applications (dApps). It aims to provide a self-amending blockchain that can evolve without requiring a hard fork. Tezos uses a liquid proof-of-stake (LPoS) consensus mechanism, where token holders can participate in the consensus process by delegating their tokens to bakers (the equivalent of miners in other blockchain networks) to validate transactions and create new blocks.

How to stake Tezos?

Tezos Staking Manual

Step-by-Step Guide to Staking TEZ via Temple Wallet

This guide will take you through the process of staking Solana using your Temple.

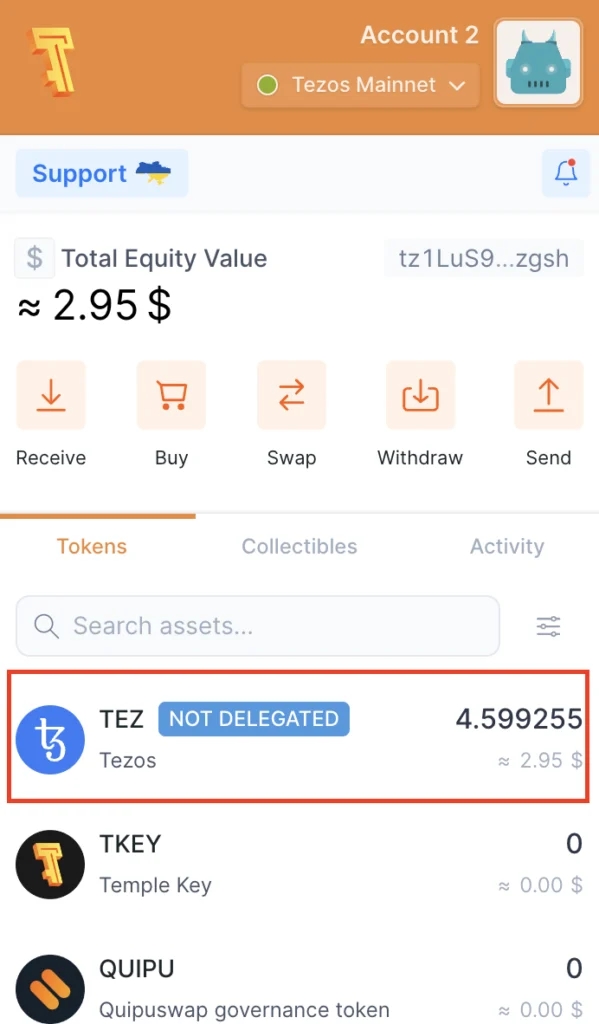

Step 1: Open the Temple Wallet

Open the Temple Wallet extension and click on your TEZ balance to get started.

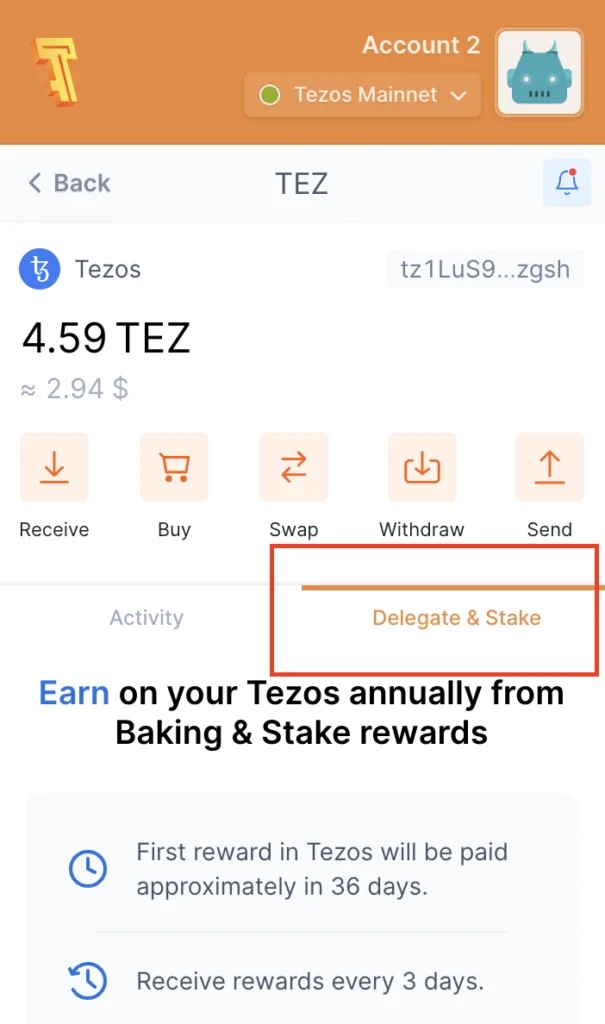

Step 2: Navigate to the Delegate & Stake Section

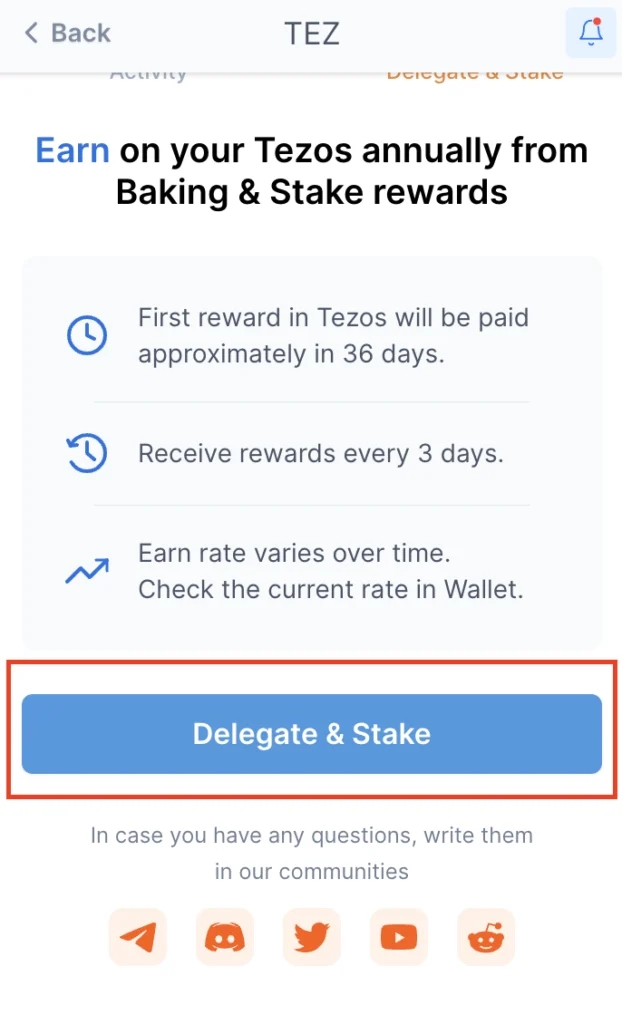

Go to the Delegate & Stake section.

Scroll down and click on Delegate & Stake.

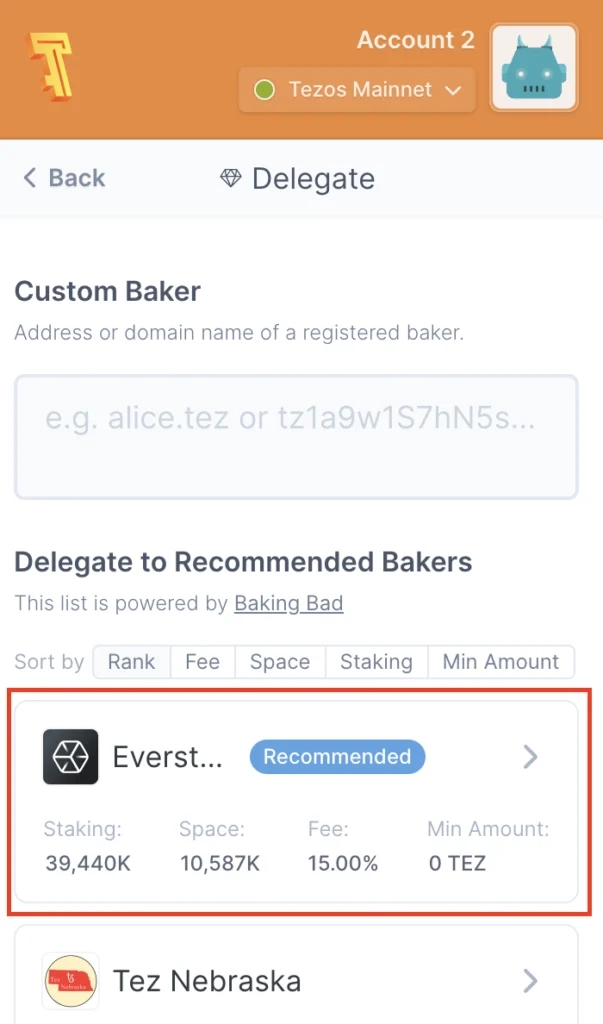

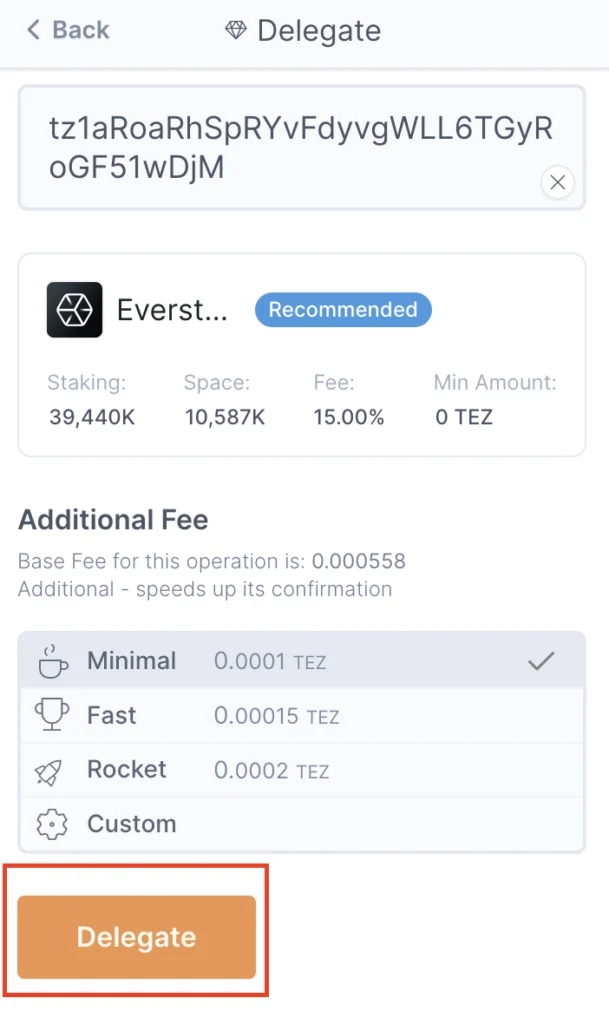

Step 3: Choose a Baker for Delegation

Before you can stake, you need to delegate your XTZ to a baker.

Choose Everstake from the list provided.

Once you’ve chosen a baker, click Delegate.

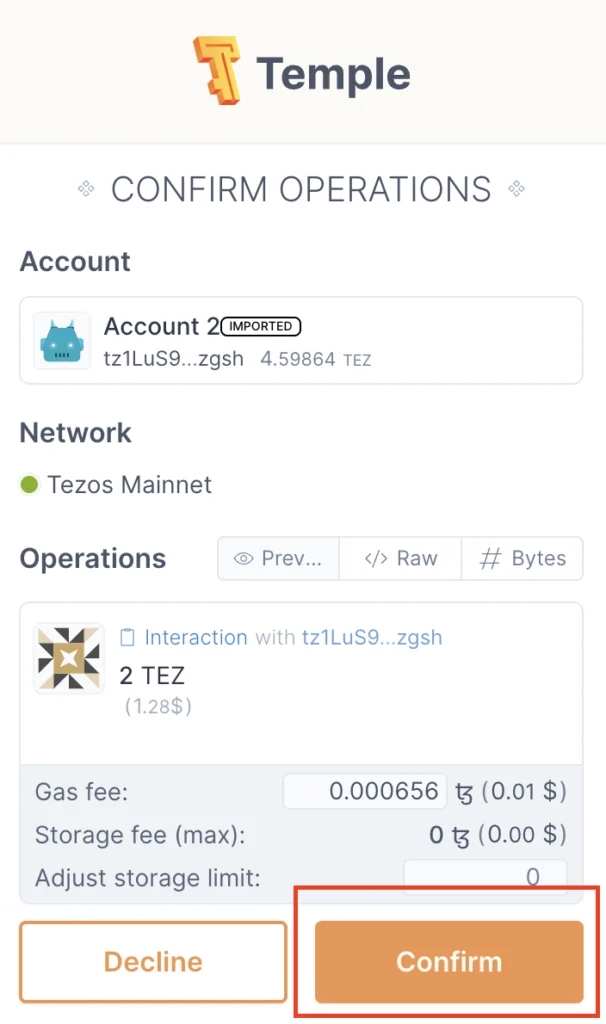

Step 4: Confirm the Delegation Transaction

Review the transaction details, then confirm to complete the delegation.

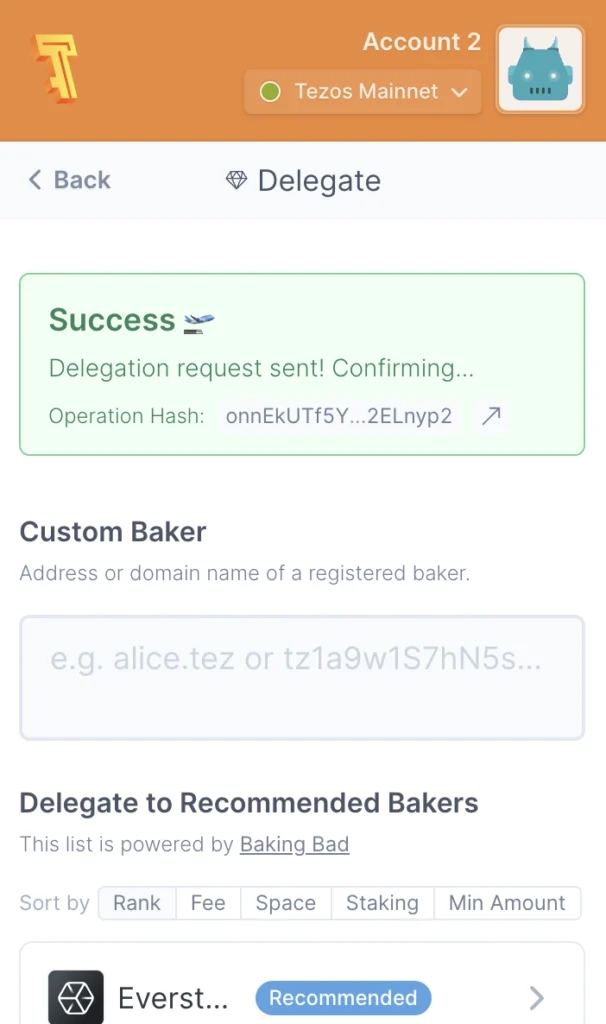

You should see a success message once the delegation is completed.

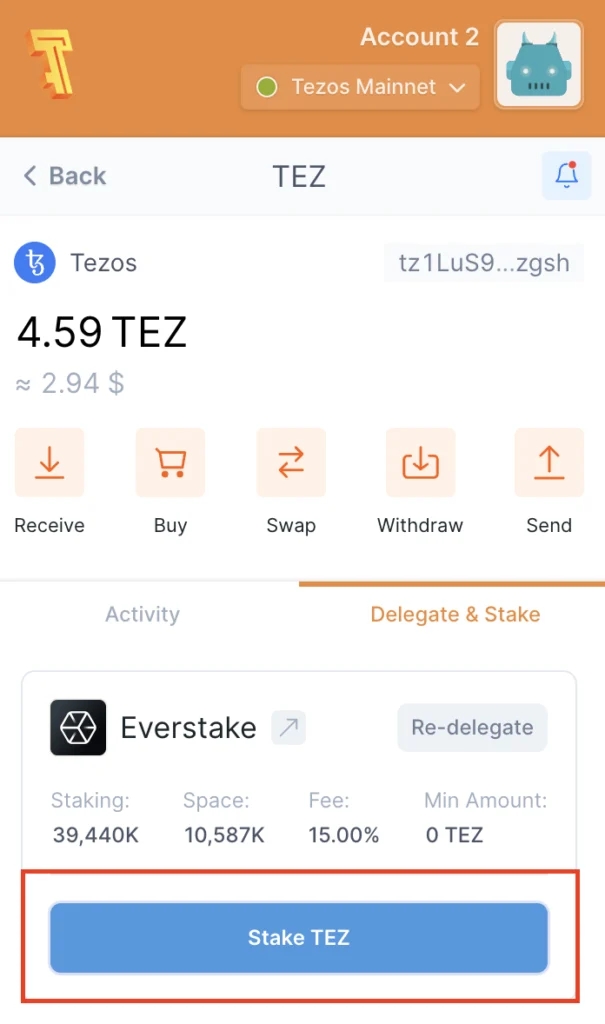

Step 5: Start Staking Your XTZ

After delegation, the Stake button will appear in the main menu.

Click on Stake TEZ to proceed.

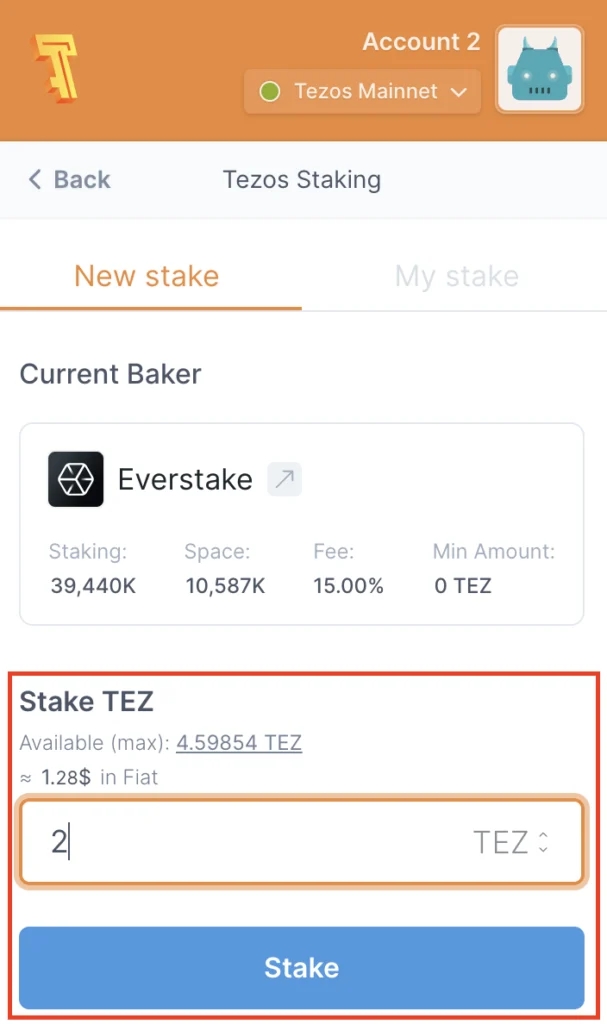

Step 6: Enter the Amount to Stake

Specify the amount of XTZ you want to stake.

Click Stake to initiate the staking process.

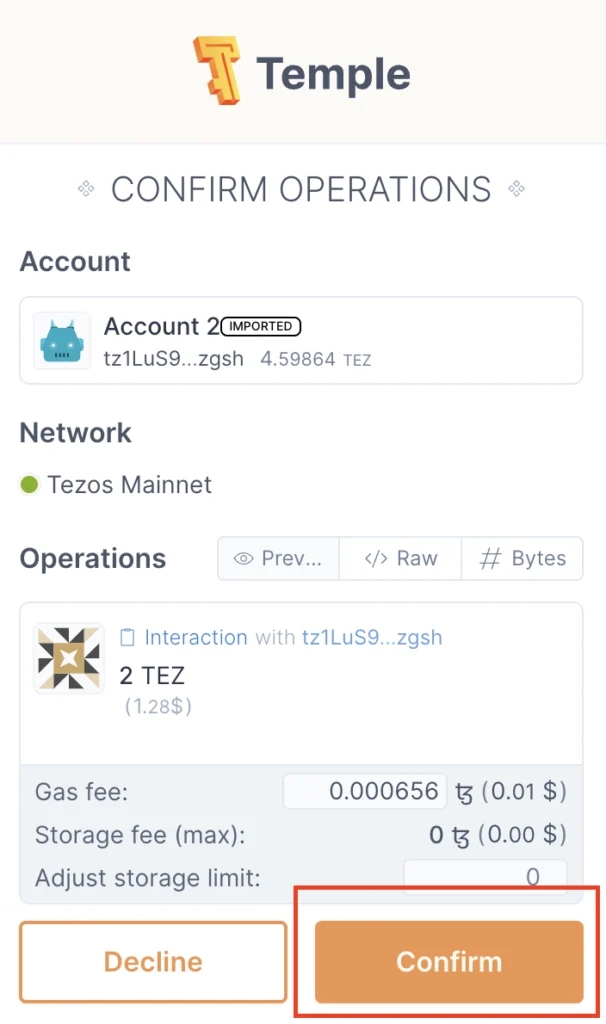

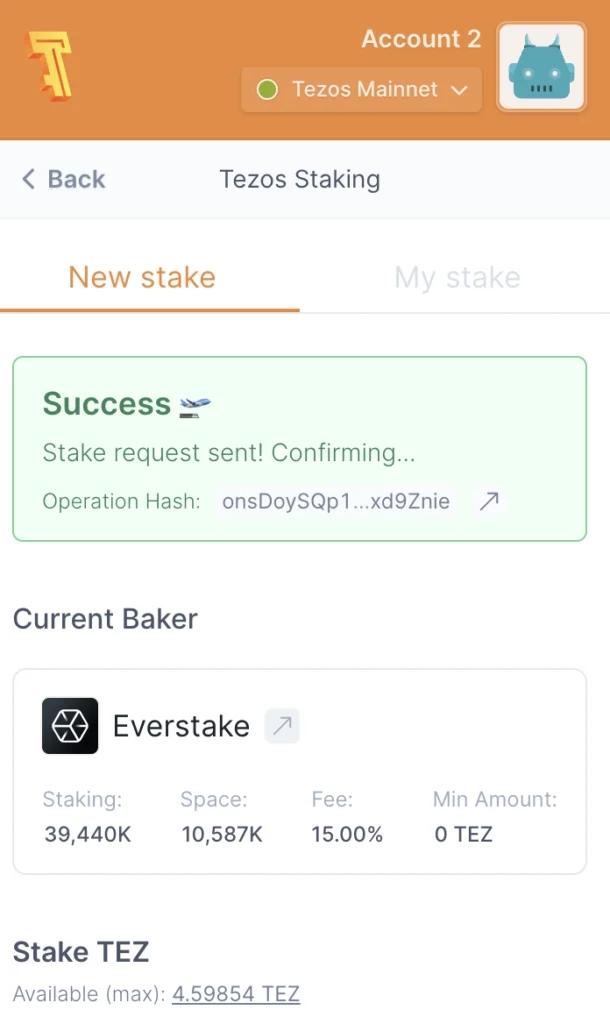

Step 7: Confirm the Staking Transaction

Confirm the transaction to finalize staking.

A confirmation screen will show once the staking is successful.

Where can I stake Tezos?

You can choose a crypto wallet convenient for you and use the guide at the link or write to Everstake support and get more detailed information

Delegation vs Staking in Tezos

Mechanism

Tezos holders could delegate their XTZ to a baker (validator) without transferring ownership.

Holders lock their XTZ as part of a baker's collateral, enhancing network security.

Rewards

Earned rewards were distributed by the baker, typically after a delay.

Earn rewards directly from the Tezos protocol, potentially higher than delegation.

Liquidity

Delegated XTZ remained liquid and could be accessed at any time.

Staked XTZ is locked for a period (typically 4 cycles, ~10 days) and cannot be accessed during this time.

Risks

No exposure to slashing, however, rewards depended on the baker's performance.

Exposure to slashing if the baker engages in malicious activities like double baking.

Status

Liquid

Frozen

Baking Rights

33%

100%

Voting Power

100%

100%

Slashing

No

Yes

Receiving Rewards

From baker

From protocol

First Reward

~ in 4 days

Immediately

Locking Period

Immediately available

4 days

Staking Details

Epoch (cycle) duration

1 day

Everstake fee

Delegation: 15% Staking: 8%

Auto-compounding

Yes

Fee to activate the wallet

~ 0.257 XTZ

First reward info

Delegation: In 2 days after stake is active Staking: Immediately

Reward frequency

Per cycle

Min amount to stake

There is no obligatory minimum

Unstaking period

Delegation: None Staking: 4 days

Stake activation time

Delegation: ~5 cycles Staking: Immediately

Re-delegating activation time

Delegation: ~5 cycles Staking: 4 cycles

Last Reward

Delegation: 4 cycles following the completion of the unstaking period Staking: Rewards end as soon as unstaking occurs

Self-Bond

None

Active set

None

Slashing

Delegation: No Staking: Yes. If a baker double-bakes, stakers could lose up to 10% of their stake. In the case of a double endorsement, the loss could be 50%. However, such events are extremely rare on Tezos.

Stake deactivation time

Delegation: Immediately Staking: 4 cycles

Why Everstake?

Everstake is the №1 staking infrastructure platform, trusted by over 1.5M users and institutional clients worldwide. Committed to the highest standards of compliance with certifications such as SOC 2 Type II, CCPA/CRPA, ISO 27001, and GDPR, we deliver secure and reliable staking solutions across 30+ supported chains with a reliability rate of 99.98%

Our skilled team manages reliable infrastructure, prioritizing the safety of your funds. Delegating through Everstake offers opportunities to boost your yields while ensuring peace of mind about your token's security.

Everstake Participation

At Everstake, we proudly operate as a trusted baker on the Tezos network, contributing to its decentralization, security, and long-term development. Our team ensures stable block production, high uptime, and transparent reward distribution for all delegators. We actively participate in Tezos governance by reviewing and voting on proposals that drive the network’s evolution. Through our technical expertise and community engagement, Everstake remains committed to supporting the growth and sustainability of the Tezos ecosystem.

Tezos Glossary

Baker

A validator in the Tezos network responsible for creating and endorsing blocks. Bakers secure the network and receive rewards in XTZ.

Double Baking / Double Endorsing

Misbehavior by a baker who tries to validate two conflicting blocks (double baking) or endorsements (double endorsing). Can result in slashing (loss of up to 10% or 50% of stake, respectively).

Adaptive Issuance

A dynamic mechanism (introduced in 2024) that adjusts new XTZ issuance to maintain around 50% staking participation, balancing security and inflation.

Adaptive Maximum

The upper limit of staking rewards dynamically adjusted by the adaptive issuance mechanism to prevent excessive inflation.

Tezos Upgrade

A protocol update approved through governance voting (e.g., Paris, Oxford, Quebec). Each upgrade may introduce economic or technical improvements such as Adaptive Issuance.

FAQ

What is XTZ?

XTZ is the native cryptocurrency of the Tezos blockchain. It is used to pay for transactions, participate in network governance through voting, and earn rewards by staking or delegating to bakers. XTZ enables holders to actively support the network while benefiting from its decentralized protocol.

Tezos Tokenomics

Tezos Adaptive Maximum Issuance is a protocol feature introduced with the Quebec upgrade that dynamically adjusts the maximum rate of token issuance to influence staking rewards and maintain network stability by pushing the staked ratio toward a target of 50%. When the network's staking ratio is below the 50% target, the issuance maximum is higher to incentivize staking, and as it approaches the target, the maximum issuance decreases to curb excessive inflation, ensuring the network's security and economic health are balanced.

How Everstake deduces validator fee?

“Validator fee” refers to the rewards received by Validator for participating in the Blockchain network Validation process. Everstake determines the validator fee through a process involving analysis and consideration of various factors, such as network requirements, operational costs, and market dynamics.

Control over User's Funds

Validators don't have control over users' funds in blockchain networks. Instead, they validate transactions and participate in the consensus process based on the rules defined by the network protocol. Users retain control over their funds through private keys, which are used to sign transactions and authorize transfers. Validators' roles involve confirming the validity of transactions and blocks, but they don't have the authority to access or manipulate users' funds.

Rewards Distribution

Delegation Rewards:

Rewards are distributed by bakers. Everstake distributes rewards every cycle (every day).

Staking Rewards:

Staking rewards are distributed automatically by Tezos protocol at the end of each cycle. The rewards are generally higher compared to delegation, as stakers are more actively involved in the network's operations.

Both delegation and staking offer opportunities to earn rewards on the Tezos network. Delegation provides a more flexible and lower-risk option with higher liquidity, while staking offers higher rewards at the cost of reduced liquidity and increased involvement. The choice between the two depends on individual preferences regarding risk, reward, and participation level.